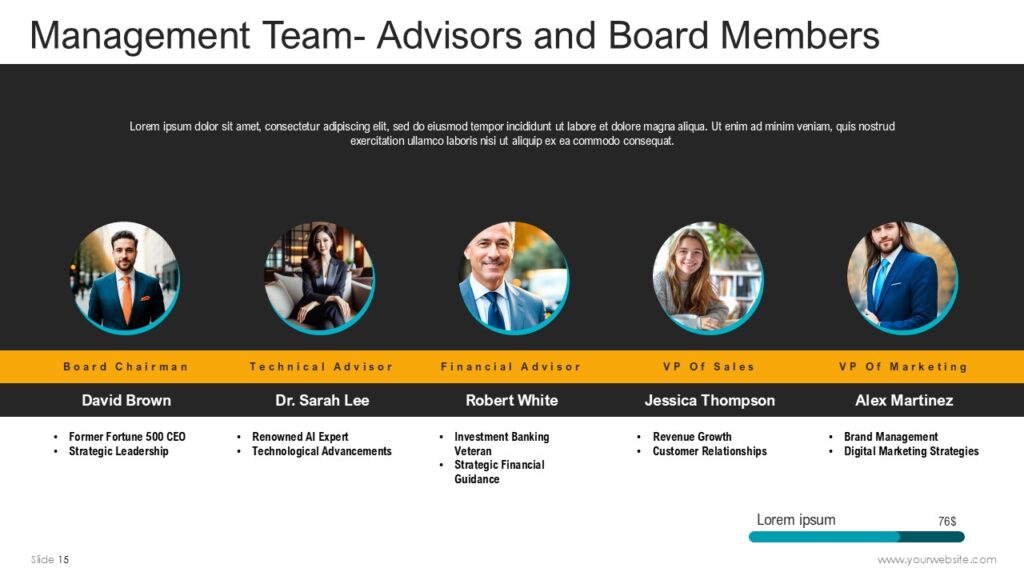

Investors often bet on people as much as they do on ideas. Use this slide to introduce the key members of your team. Highlight their relevant experience, skills, and what makes them essential to your business’s success.

Investors want to see that your team has the experience and capability to execute the business plan. Highlight any past successes, industry expertise, and complementary skills among team members. If you have advisors or board members with strong industry connections, mention them too. The goal is to instill confidence that your team can navigate challenges and drive the business forward.

Clearly define the problem your business is addressing. This slide is critical as it sets up the premise for your solution. Ensure that the problem is significant and relatable to your audience. Use data, case studies, and real-world examples to illustrate the problem’s severity and relevance. The more effectively you can convey the urgency of the problem, the more compelling your solution will appear.

Investors are interested in problems that represent significant market pain points because solving them can lead to substantial business opportunities. The problem should be large enough to warrant a viable market. Provide data and real-world examples to underline the severity of the problem. The more clearly you can articulate the problem, the easier it is for investors to see the value in your solution.

What gives your business an edge over the competition? This slide should highlight your unique value proposition—what makes your solution better, faster, or more efficient than others. Explain how your product or service addresses the problem in a way that no one else can. This could include proprietary technology, a novel business model, or unique market insights that others don’t have.

Investors are looking for a competitive advantage that is sustainable and defensible. Explain how your business model, technology, intellectual property, or operational efficiencies provide a moat that competitors cannot easily cross. Demonstrating a unique advantage helps reassure investors that your business can maintain its edge and profitability over time.

Now that you’ve presented the problem, it’s time to unveil your solution. Explain how your product or service effectively solves the problem you’ve identified. Detail the features and benefits of your solution, and how it stands out from existing alternatives. Provide examples or case studies that show your solution in action, and illustrate the impact it can have.

Investors want to know that your solution is not only innovative but also practical and scalable. Offer evidence of how your solution addresses the problem better than existing alternatives. Be prepared to answer questions about feasibility, scalability, and implementation. Use metrics, customer testimonials, or case studies to back up your claims.

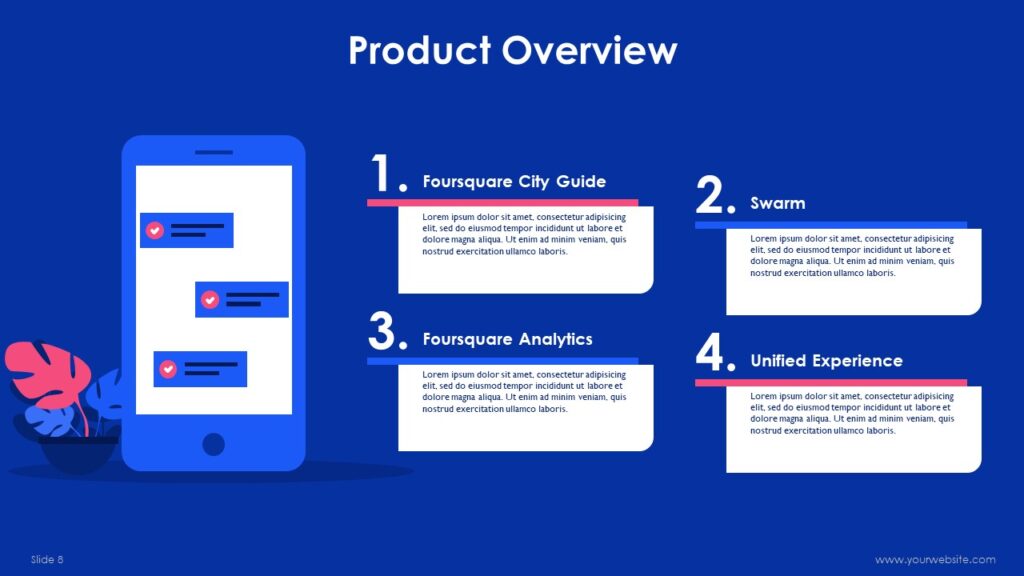

Delve deeper into the specifics of your product or service. How does it work? What are its features? Provide a demo, screenshots, or product mockups to give investors a clear understanding of what you’re offering. Discuss the product development roadmap, including key milestones that have been achieved and those that are upcoming.

Investors are looking for products that are either market-ready or have a clear path to market. If possible, include a product demo, prototype, or screenshots to illustrate the user experience. Discuss the product development roadmap, highlighting key milestones already achieved and what remains to be done. This slide should give investors a clear understanding of your product’s functionality and potential for market adoption.

Investors want to see proof that your business is gaining momentum. Use this slide to present key metrics that demonstrate traction—customer growth, revenue milestones, partnerships, or any other indicators that show your business is on the right path. Highlight any early adopters, user testimonials, or repeat customers that validate your product’s value.

Traction is often seen as a validation of your business model. Show any early adopters, revenue growth, user engagement statistics, or strategic partnerships that illustrate market acceptance. If you’re pre-revenue, focus on user growth, product usage, or any other metric that shows progress. Investors are more likely to invest in a business that has already demonstrated some level of market traction.

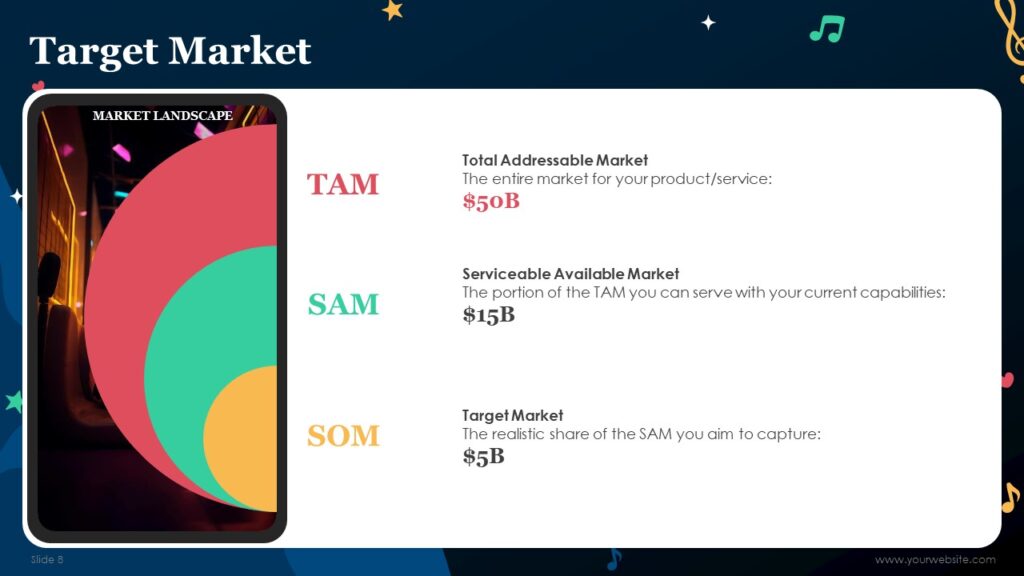

Every investor wants to know about the market opportunity. How large is your target market? What are the trends, and where do you fit within the market landscape? Use this slide to provide a comprehensive market analysis, including the Total Addressable Market (TAM), Serviceable Available Market (SAM), and your expected market share.

Investors are interested in markets that are large, growing, and have significant unmet needs. Use this slide to show the Total Addressable Market (TAM), Serviceable Available Market (SAM), and your expected market share. Highlight market trends, emerging opportunities, and why now is the right time for your business to succeed. A well-researched market opportunity makes your business more attractive to investors.

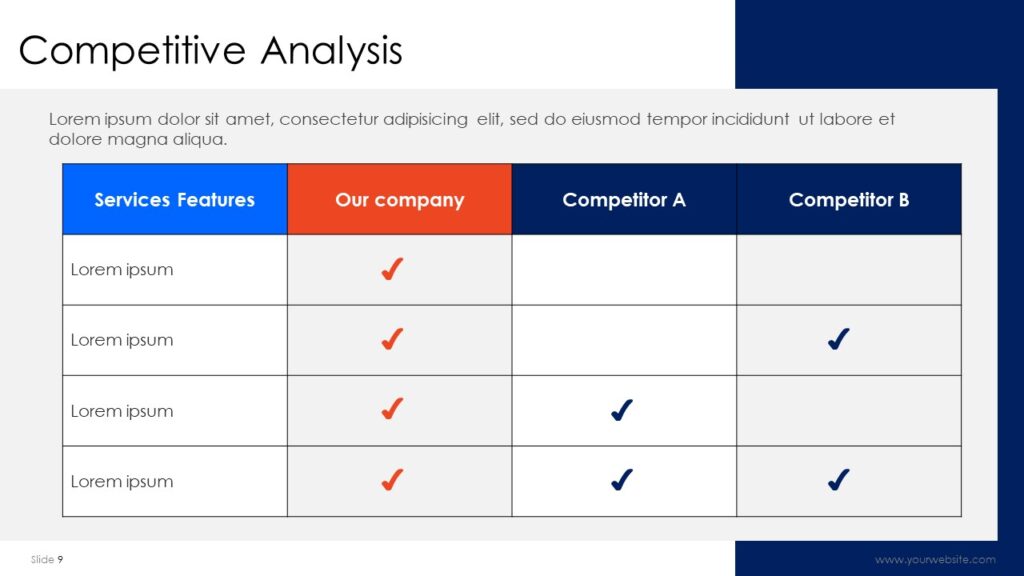

No business operates in a vacuum. Use this slide to identify your competitors and explain how you differentiate from them. Provide a competitive analysis that shows where your business stands relative to competitors. Use tools like SWOT analysis or quadrant charts to visualize your competitive landscape.

Investors want to see that you understand your competitive landscape and have a strategy for differentiating yourself. Provide a competitive analysis, possibly using a quadrant chart or SWOT analysis, to show where your business stands relative to competitors. Discuss your competitors’ strengths and weaknesses and how you plan to leverage your advantages to capture market share. A clear differentiation strategy reassures investors that your business can thrive in a competitive market.

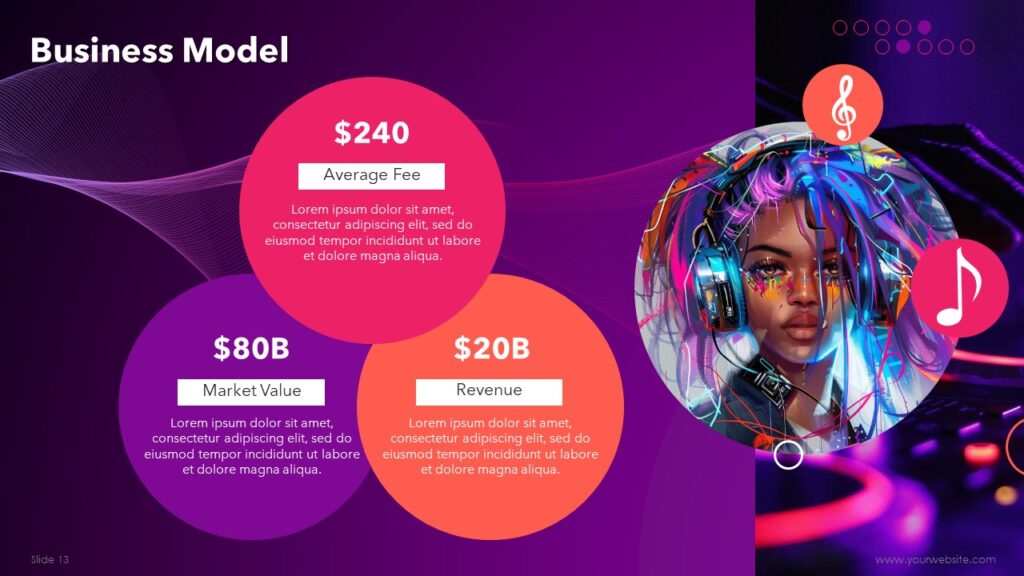

How does your business make money? This slide should outline your revenue streams, pricing strategy, and any other aspects of your business model. Explain how your business generates revenue and how it plans to grow its customer base. Detail your pricing strategy and how it aligns with your market positioning.

This is where you outline your financial needs. How much capital are you seeking, and what will you use it for? Provide a detailed breakdown of how the funds will be allocated, and what milestones you plan to achieve with the investment. Include your financial projections, including revenue forecasts, break-even analysis, and expected ROI.

Investors want to know exactly how their money will be used and what they can expect in return. Provide a clear breakdown of your funding needs, how the funds will be allocated, and what milestones you plan to achieve with the investment. Be transparent about your financial projections, including revenue forecasts, break-even analysis, and expected ROI. A well-articulated ask shows that you have a solid plan for using the investment to drive growth.

Close your pitch deck with a slide that makes it easy for investors to get in touch with you. Provide your contact details and encourage follow-up conversations. Make sure to include multiple ways to contact you—email, phone, LinkedIn, and website. This slide should leave investors with a clear path to reaching out for more information or setting up a meeting.

This slide is about making it as easy as possible for investors to reach out. Include multiple ways to contact you—email, phone, LinkedIn, and website. A professional and responsive follow-up process is critical, as it shows you are serious about securing investment and value investor relationships.